In the fast-paced world of fintech, “gut feeling” is a relic of the past. Today, the difference between a market leader and a cautionary tale usually comes down to how quickly a team can turn raw data into a strategic move. This is where Business Intelligence (BI) tools have shifted from being a “luxury add-on” to the literal nervous system of the enterprise.

For finance professionals, BI isn’t just about pretty charts; it’s about clarity at scale.

Why BI is Non-Negotiable in Today’s Economy

The sheer volume of financial data—from real-time transactions and API logs to global market fluctuations—is overwhelming. BI tools act as the bridge between “drowning in data” and “driving with data.”

- Real-Time Risk Mitigation: Traditional reporting is often “rear-view mirror” thinking. BI allows for live dashboards that flag anomalies, credit risks, or liquidity gaps the moment they happen.

- Democratizing Data: You no longer need a PhD in data science to understand your quarterly burn. Modern BI tools use natural language processing (NLP), allowing managers to ask, “What was our CAC-to-LTV ratio in Q3?” and get an instant visual answer.

- Predictive Power: Beyond telling you what happened, AI-integrated BI tools analyze historical patterns to forecast future cash flows and market trends.

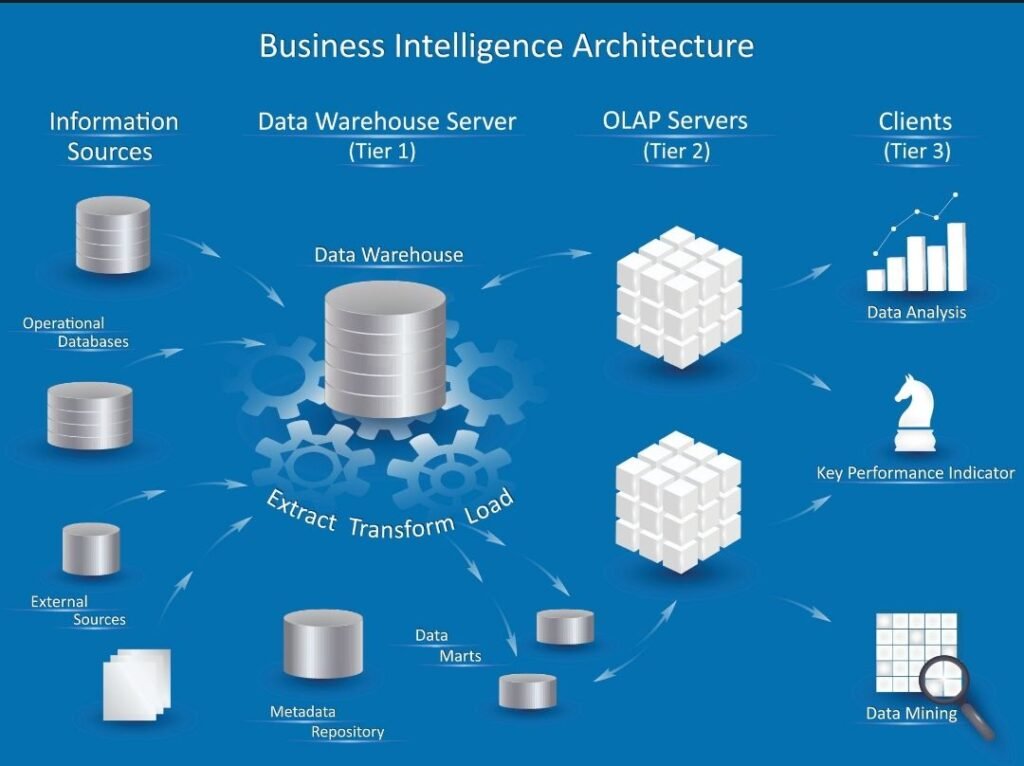

The Anatomy of a Modern BI Stack

When we talk about the “algorithm” of a successful business, we are looking at how these tools process information. Most top-tier platforms follow a three-step journey:

Ingestion & Integration: Pulling data from your CRM, ERP, and banking APIs into a centralized “Single Source of Truth.”

Processing (The Engine Room): This is where the heavy lifting happens—cleaning the data, removing duplicates, and applying financial logic.

Visualization: Converting those complex datasets into intuitive, interactive heat maps, waterfall charts, and trend lines.

Choosing the Right Tool for Your Tech Stack

While the market is crowded, the “best” tool depends entirely on your existing infrastructure.

Here are the top contenders:

Microsoft Power BI: Best for teams already deep in the Microsoft ecosystem. It offers seamless integration with Excel and Azure.

Tableau: The gold standard for deep, complex data visualization. It is unmatched for aesthetic and analytical depth.

Looker: Ideal for cloud-native, tech-forward teams that need strong data modeling and real-time Google Cloud integration.

Metabase: A great choice for startups and lean teams. It is often open-source and incredibly easy to set up for basic queries.

The Human Element: Insights Over Inputs

Algorithms are brilliant at finding patterns, but they lack context. The most successful finance teams use BI tools to automate the “drudge work” of data entry so that the humans can focus on the why.

In the fintech space, the goal isn’t just to have more data—it’s to have shorter distances between a data point and a decision. If your current tech stack feels like it’s slowing you down, it might be time to stop looking at spreadsheets and start looking at a BI dashboard.